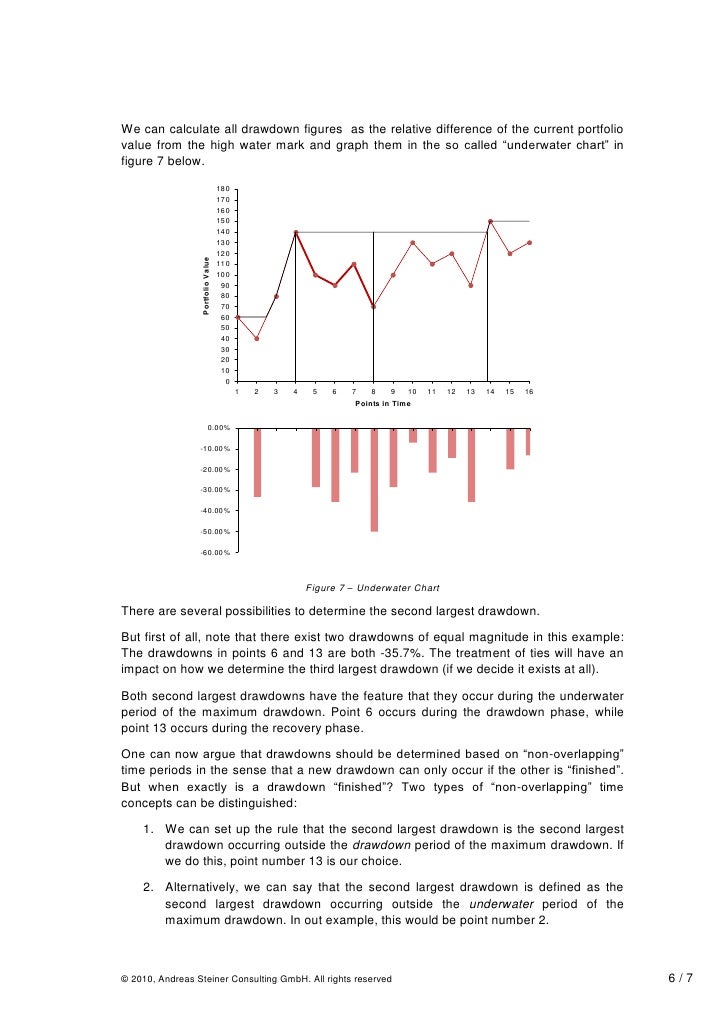

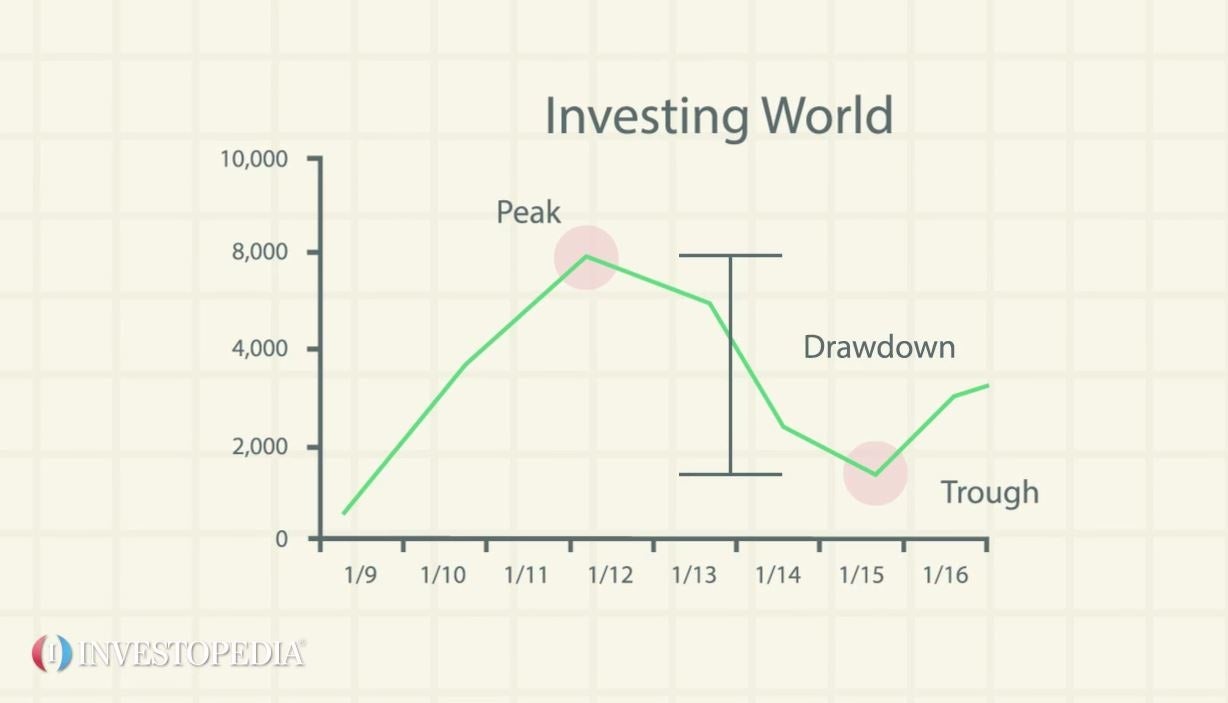

This loss from the peak is given by the maximum drawdown. This method sets the protection level as a predefined percentage loss from the peak value of the portfolio. The first one we introduce is the Maximum Drawdown extension.

There are a few extension models one can use to improve their CPPI strategy. Because of this, it is recommended to set the multiplier as a function of the maximum potential loss within a given trading interval. That gap risk materializes if and only if the loss on the risky asset exceeds 1/M within the trading interval. The risk of breaching the floor this way is called “the gap risk”. The loss of the risky component can become large enough that you get below the floor between two trading dates. However, this creates an opportunity for things to go wrong. Because transaction costs go up the more often you trade, you may want to trade on a less frequent basis, e.g. However, we have to take into an account the transaction costs and the gap risk. The most significant benefit of CPPI strategy is that if you were able to trade continuously, nothing could go wrong. This means you are allocating nothing to the portfolio’s risky portion, and 100% is invested in the safe component of your portfolio.ĬPPI procedure creates convex option-like payoffs without actually using options. If the cushion goes to zero (the value of the portfolio hits the floor), your allocation to the risky assets is the multiplier M times zero.

Thus, as the cushion decreases, you are reducing the risky asset allocation. The difference between the current portfolio value and the floor is then called cushion it is the value you can put at risk.Īt every point in time, you can allocate multiplier M of the cushion to the risky assets. This is the floor (the value, you don’t want to go below). It’s then easy to calculate how much may the portfolio value decline at each point in time t, so that the safe asset will be able to recover the loss back to the protection level: the minimum value you want to protect (for example its starting value, s) and the protection period in years, T. Firstly, choose the protection level of the portfolio, i.e. Imagine a portfolio consisting of two types of assets, “safe” (with a given yield y) and “risky”. The main principle behind the CPPI strategies is not complicated at all. It’s a favourite strategy often used to build protected funds or as a part of various synthetic derivative products.

ACCEPTABLE MAXIMUM DRAWDOWN PRO

Quantpedia Pro clients can use the model portfolio built in the Portfolio Manager as a risky asset to test various variants – Basic CPPI, Drawdown Based CPPI and Dynamic Multiplier CPPI.ĬPPI (Constant Proportion Portfolio Insurance) is a strategy that allows an investor to keep exposure to a risky asset’s upside potential while providing a guarantee against the downside risk by dynamically scaling the exposure. Putting drawdowns and the Maximum Drawdown (MDD) together in a dataframe so you can compare the result: > df_dd = pd.9.July 2021 asset allocation asset class picking own-research theory of portfolio managementĪs we have promised, we present a short article as an introduction into the methodology of the Quantpedia Pro CPPI reports. > drawdown = 1 - final.div(final.cummax()) Pandas.expanding will apply a function in the manner pandas.rolling does, but with a window that starts at the beginning of the dataframe and expands up to the current row (more info about the Window Functions here and pandas.expanding): > cum_returns = (1 + final).cumprod() You can get a dataframe with the maximum drawdown up to the date using pandas.expanding()( doc) and then applying max to the window. ReturnsĬode: cum_returns = (1 + final).cumprod()Ĭan anyone help me in solving this. Is there any way possible to calculate the maximum draw down using returns of the portfolio.

ACCEPTABLE MAXIMUM DRAWDOWN CODE

I have tried the below code and did see many stackexchange questions. I am trying to calculate the MaxDrawdown using the returns.

I have DataFrame final with returns of my portfolio.

0 kommentar(er)

0 kommentar(er)