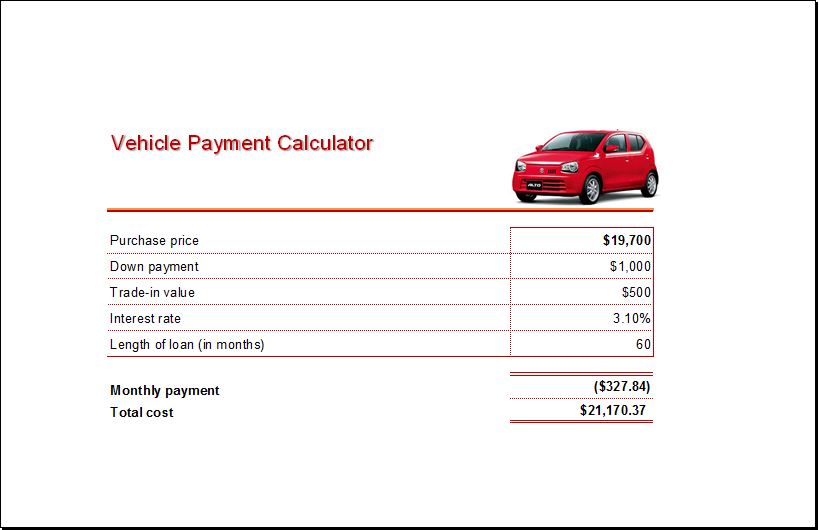

It is your monthly payment in the loan from our example. Use the appropriate formula to compute the monthly payments:.It is the value of a new car minus the money you get from selling an old car and money you can withdraw from your bank account: Calculate the amount of money you need to borrow.Estimate the amount of money you will get for your old car.

To calculate the monthly payments, we need to stick to the following steps: The sales tax in your state is 10%, and the interest rate on the car loan is 4%. You also have a car – an old Chevrolet Silverado worth about $7,000, and $1,500 in your saving account. Now we know the formula used in the car loan payment, we can try to perform a sample calculation.įirstly, let's assume that you want to buy a five-year-old Jeep Wrangler worth $20,000. Usually, it is more profitable to buy a new car with dealership financing, as it is significantly cheaper – interest rates in such loans can be as low as 0.5%, 1%, or 1.5%. Note that to promote sales, car manufacturers offer attractive financing opportunities via dealers. In dealership financing, you usually cannot choose the lending institution – usually, the loan is granted by so-called captive lenders associated with a car manufacturer. In dealership financing, a car dealer initiates the process of taking a loan and doing all the necessary paperwork.You sign a purchase contract with a car dealer and then use the money borrowed from the direct lender to make the appropriate payments. Direct lending is a typical loan taken from a bank or credit union.When considering taking a car loan to buy a new car, it is worth knowing that there are two main types of financing on a car loan: direct lending and dealership financing. The general rule of thumb says that the smaller amount you borrow, the higher the interest rate is. The interest rate is typically constant over the lending period and depends on how much you borrow. After the purchase, you must repay it in fixed monthly payments, usually over one to five years (12 – 60 months). In the simplest case, it is the price of the car minus the money you have.Ī car loan allows you to borrow a fixed sum of money you need to buy the vehicle. Basing the calculations on that price, you should be able to work out the amount you need to borrow.

Once you find the car you want to buy, you usually know its price. If you are shopping around for car loans, you may check our loan comparison calculator, which can give you excellent support in choosing the most favorable option. If you're considering buying a recreational vehicle, check our RV loan calculator.

#Automotive finance calculator how to#

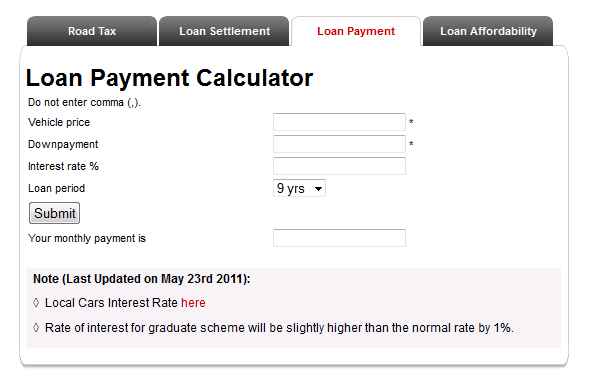

We will also explain to you step by step how to calculate the monthly payments on any car loan and how to take into account sales tax.

0 kommentar(er)

0 kommentar(er)